Biometric Payments: Real Use Cases and Benefits

"In recent years, we have seen biometric payments turning from novelty into mainstream deployment—and for good reasons. The procedure of unlocking mobile wallets with a fingerprint or checking out with a face scan is quick, frictionless, and secure. In fact, more than half of consumers report using biometric authentication on a regular basis as of 2025, largely because it feels more secure than traditional methods."

So, what real use cases are biometric payment solutions seeing today? Are some regions faster than others at adopting them? And what are the concerns, if any?

In this article, we will answer these questions and more, as we review the current state of biometrics in payments.

What are biometric payments?

Biometric payments are transactions authorized by checking physical or behavioral traits instead of passwords or PINs. A biometric payment system confirms the payer through fingerprint recognition, facial recognition, voice recognition, and/or iris or palm imaging, and then issues an approval or a denial. This model is mostly used by mobile wallets, camera or palm terminals at checkout, and banking apps for e-commerce that accept device biometrics in place of a PIN.

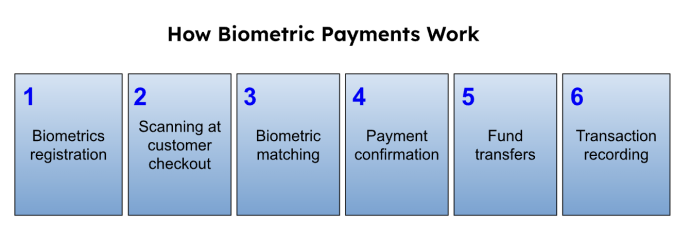

The core flow in a biometric payment system:

Biometric payment methods

Biometrics in payments are not limited to face scans: there are plenty of methods used to verify a person's identity, and some are more common than others. Let's take a look at all of the current methods for facilitating secure transactions:

Facial recognition:

Customers typically enroll through an app, and at checkout a camera terminal captures and matches their face with added liveness checks. Using software like Regula Face SDK, liveness is checked by prompting small gestures such as smiling, blinking, or slight head turns.

Fingerprint recognition:

This is another widely used biometric payment system, most often integrated into mobile wallets like Apple Pay, Google Pay, and Samsung Pay. Banks have also issued biometric cards with embedded sensors, but with limited adoption so far.

Palm recognition:

Quickly hovering a hand over a scanner can complete a biometric payment, with the device using infrared to detect vein patterns inside the hand. At the same time, a number of other developments focus more on surface features than veins.

Iris recognition:

Still rarely seen, but in practice, it has been combined with face recognition in systems like PayEye in Poland, which uses both traits for greater reliability. Iris scanners require specialized near-infrared hardware, which raises costs and limits widespread use in consumer payment systems.

Voice recognition:

Not present at physical checkout but does see real use in call center transactions. Institutions protect themselves from fraud through voiceprints before allowing payments, as voice deepfakes are amongst the fastest growing threats, with a reported 1,300% surge in 2025.

Real-world implementations of biometric payment solutions

Biometric payment authorization is already being deployed by banks, retailers, and online platforms. In this section, we will highlight several concrete implementations.

Mobile wallets and online payments

Apple Pay, Google Pay, and Samsung Pay all incorporate local device biometrics as an authentication step for both in-person NFC payments and online purchases. More specifically, users rely on the phone's fingerprint sensor to verify their identity.

Alternatively, users can scan their faces with their phone camera, and the system will then perform face matching. This ensures that the person attempting a payment is identical to the one associated with the digital wallet's owner.

Market Adoption Statistics:

These types of mobile payments are now widespread: nearly 60% of consumers globally had used a digital wallet in the last 90 days, according to a 2025 study. A key reason cited is convenience coupled with security, both of which biometric payment solutions provide.

Many banks have also shifted their two-factor authentication methods to biometrics. Under regulations like Europe's PSD2, strong customer authentication is required for online payments, and biometrics are one way to satisfy this. European customers now often see biometrics in banking firsthand, as they use fingerprint or face ID inside the app to complete transactions.

All of these examples illustrate how biometric ID verification is benefiting digital payments: users get faster logins and checkouts, while businesses get higher assurance that people making transactions are legitimate.

Point-of-sale biometrics

Another trend of late has been the emergence of biometric verification at physical points of sale. The motivation in such cases is often to reduce lines: it has been reported that transactions via facial recognition can take under 5 seconds, which can be faster than performing a cash or card payment. There's also the hygiene factor, amplified by the COVID-19 pandemic—the idea of not touching any shared keypad is more appealing to some consumers.

In Asia, China has deployed thousands of facial recognition payment terminals in retail stores, subway stations, and even vending machines. With their faces linked to their Alipay or WeChat account, customers can often pay by smiling—the system is literally named "Smile to Pay"—or just looking at the face scanner.

Our identity—in our hands

Palm-print scanning is also gaining popularity, as many people feel it's less invasive than face recognition. For example, the WeChat Pay service allows Beijing metro passengers to pay for rides using only their palms. To do so, palm prints must be taken at a designated machine at a metro station for later use over a scanner at metro station turnstiles. As of 2025, such terminals are a known payment method (as opposed to contained pilot programs), which makes the country a trailblazer in the field of point-of-sale biometrics.

In Latin America, fintech startups are partnering with a number of merchants to deploy face-pay systems. Back in 2022, Brazil's Payface (working with Mastercard) started to allow shoppers in São Paulo to enroll a faceprint and pay at grocery stores purely by looking at a tablet at checkout. They have since expanded their reach to the Asia Pacific region and have also been launching palm-print scanning pilot programs.

In Europe, organizations have been more cautious to adopt these technologies, with strict regulations and stronger privacy culture being significant factors. However, a few pilot programs have taken place recently: Poland's bookstore chain Empik saw iris and face biometrics installed at five locations in 2024.

This initiative was powered by Mastercard, as their team believed Poland would be more receptive to new technologies than some other European countries. According to their survey, four out of five Polish residents confirmed using biometrics at least once.

Biometric payment cards

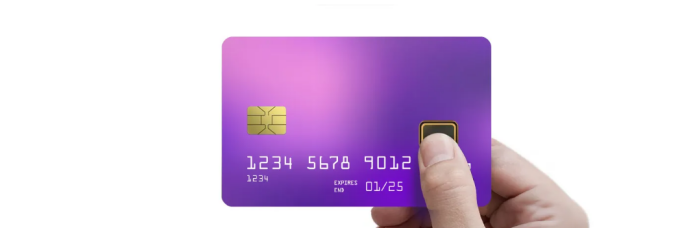

There's an even newer wave of biometric payments: bank cards that contain fingerprint sensors. The miniature fingerprint scanning pad, usually placed on one corner of the card, captures a live fingerprint image and runs a match against the stored template in the card. If it matches, the chip signals to the terminal that the transaction is approved, essentially acting as a replacement for PIN codes.

Market Projections:

While countries like Bangladesh and Turkey introduced biometric debit cards last year, the scale of implementation is still very modest. A report in March 2025 projected just 1.27 million biometric cards shipped globally by 2029, which is a tiny fraction of the billions of cards in circulation now. High manufacturing costs and the lack of a standardized, easy enrollment method are cited as reasons banks have not gone all-in.

Benefits of biometric payments

Supporters of the technology argue that biometrics make transactions faster and more secure, while critics express concerns about privacy risks—and both groups make valid points. Let's now examine in greater detail the pros and cons of biometric payment solutions.

Faster checkouts

Performance Benefits:

One of the biggest selling points of biometric payments is speed. Scanning your fingerprint or face can shave time off the checkout process: for example, J.P. Morgan's biometric payment pilot (using palm and facial recognition) found that the technology significantly sped up transactions, even in busy environments like sporting events. In a trial at the Formula 1 Miami Grand Prix in 2024, 100% of transactions using biometrics were authenticated and processed successfully in under one second.

Improved security

Security Advantages:

Biometric identifiers are unique to each person and far harder to fake or steal than a PIN or password. Payment industry research confirms this: according to Stripe, biometrics can greatly lower the risk of unauthorized purchases.

Various programs are beginning to back up these claims: Amazon, for example, rolled out its Amazon One palm-payment system and reports extremely high accuracy from its biometric tech. This suggests that well-designed biometric systems can virtually eliminate the chance of the wrong person being mistakenly authenticated for payments.

Integrated loyalty

Payment authentication solutions can also instantly connect you to your customer profile, which opens up more new interesting benefits. For merchants, linking biometric authentication to loyalty programs means customers can automatically accrue points or receive discounts without scanning an app or entering a phone number. People are more likely to use their loyalty benefits when it requires no additional effort, since a quick face scan can handle everything.

Inclusive and accessible payment options

Some people may struggle with PIN codes, passwords, or physical cards, none of which are a factor in biometric payment solutions. Elderly customers or individuals with certain disabilities can enjoy more accessible financial services, as biometrics rely on something inherent (their body) rather than devices or keys. Fingerprint-based payment systems have reportedly helped bring basic banking to rural populations in places like India, where many residents lack formal IDs or can't easily use ATMs. The Aadhaar Enabled Payment System allows people to withdraw cash or check balances at local agents using just their fingerprint and national ID number—no PIN or card required.

Making biometric payments possible with Ciontek

As tools like fingerprint recognition are becoming more and more common methods of approving transactions, Ciontek has already integrated advanced fingerprint recognition capabilities into a range of its flagship products—including the highly acclaimed CS10 and CS50 POS terminals. These biometric-enabled devices deliver lightning-fast authentication, ironclad data security, and seamless user experiences, making them ideal for diverse sectors such as retail, hospitality, finance, and healthcare across international markets.

Furthermore, Ciontek's products such as CS50 support the function of face recognition. Equipped with high-performance dual cameras, up to 16 megapixels—the CS50 ensures crystal-clear image capture even in low-light or challenging lighting conditions. Built on a secure Android-based OS with global connectivity support (4G/3G/2G, Wi-Fi, Bluetooth 5.0) and certified to meet international payment standards (PCI PTS 6.x, EMV L1 & L2), the facial recognition capability of CS50 can provide a secure and reliable application environment for payment.

Have any questions? Don't hesitate to contact us, and we will tell you more about what Ciontek offer.